Bitcoin Self Custody – Sicherheitslevel im Überblick

Ayhan CelebiShare

You truly own Bitcoin only when you have control over your private keys. If you want to store your Bitcoin securely and permanently without relying on third parties, you cannot avoid the topic of Bitcoin self-custody.

There are various methods available, each offering different levels of security. In the following article, our co-founder Ayhan explores the different approaches to self-custody and their respective advantages and disadvantages.

Level 1: Self Custody – Hot Wallet ⭐

There are now numerous Bitcoin wallets available for smartphones (e.g., BlueWallet or Electrum) that stand out due to their user-friendly interface. Setting up the wallet on your smartphone takes just a few clicks. The seed phrase can be displayed, and if you back it up independently from the device, you can easily restore your Bitcoin even if your device is lost.

However, caution is advised: since the seed phrase is generated and stored on an online device, there is a certain level of risk. If the device is compromised, an attacker could potentially gain access to the seed phrase and, consequently, to your Bitcoin.

Therefore, you should never store more money in a hot wallet than you would carry in a regular wallet. While hot wallets are a good option for beginners exploring the Bitcoin world, they are not suitable for secure and permanent Bitcoin storage.

Level 2: Hardware Wallet - Single Sig ⭐⭐

Hardware wallets allow for the user-friendly setup of Bitcoin cold storage, meaning the private keys are stored completely offline, with the seed phrase never coming into contact with the internet. This minimizes the risk of hacks.

To receive and send Bitcoin, the devices are connected to a computer or smartphone via a USB connection. Air-gapped hardware wallets (like the Blockstream Jade) allow transactions to be signed using QR codes without the hardware wallet being directly connected to an online device. Generally, the recovery seed phrase never leaves the hardware wallet when properly used.

Using a single-signature (Single-Sig) wallet, where only one signature is required to authorize a transaction, is the simplest form of self-custody cold storage. When choosing a hardware wallet, it’s recommended to opt for an open-source provider like Bitbox or Jade.

Using a Single-Sig hardware wallet is the most common way to store Bitcoin and offers a very good solution, combining high security with low complexity.

Level 3: Hardware Wallet - Single Sig + Passphrase ⭐⭐⭐

For additional security, the seed phrase can be encrypted with a passphrase. This creates an entirely new wallet when combined with the seed phrase. The passphrase acts not just as a "password" but as an integral part of the backup.

Storing the seed phrase and passphrase in different locations minimizes the risk of physical attacks. If a thief finds the recovery seed backup with the 12 or 24 words, an empty wallet will open during a recovery attempt if the passphrase is not entered, as the actual wallet can only be accessed with the passphrase.

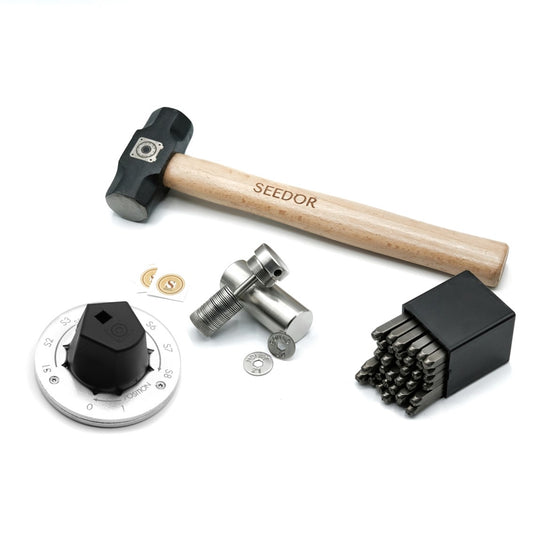

A specific risk with using a passphrase is that, unlike the seed phrase, every possible input is valid and opens a new wallet. If a typo goes unnoticed, it could have serious consequences. Therefore, the passphrase should be stored just as securely as the seed phrase itself. In our shop, you'll find a steel stamping set with lowercase letters and special characters to create a durable backup.

Level 4: MultiSig ⭐⭐⭐⭐

Multi-signature wallets (MultiSig) require a predefined quorum of private keys to authorize a transaction. The most common variant is a 2-of-3 MultiSig, where any two of three existing keys are needed to access the Bitcoin.

MultiSig offers increased protection against theft since a single key is not sufficient to authorize transactions. By geographically distributing the keys, the security level can be further enhanced. At the same time, the MultiSig architecture increases redundancy: even if one key is lost, the remaining two keys can still access the Bitcoin.

However, MultiSig also requires the secure storage of the so-called coordinator file, which contains essential information such as address type, quorum, and xpubs needed to restore the wallet.

Conclusion

The more complex the security architecture, the higher the risk of errors occurring during wallet recovery, which could lead to the loss of Bitcoin. Reports indicate that more Bitcoin has been lost due to faulty storage and overly complex backup strategies than through physical attacks.

Everyone should therefore develop a security architecture that they feel comfortable with and that suits their individual needs. If you have any questions on this topic, we are happy to offer a personal onboarding call.