How to store Bitcoin securely

Ayhan CelebiShare

How to store Bitcoin securely

Meanwhile there are numerous possibilities to store your Bitcoins, so that you can easily lose the overview. With the following article we would like to provide some clarity and give you an overview of the different storage options for Bitcoin with the respective advantages and disadvantages.

Custodial Wallets

Before storing the Bitcoins, the first step is to buy Bitcoin. This is usually done via a crypto exchange such as Coinbase, Binance or Crypto.com. After the purchase, your Bitcoins are automatically stored in a wallet on the selected platform.

When you get right down to it, this statement is actually not entirely correct. The Bitcoins are always on the blockchain and a wallet merely acts as a kind of wallet in which your private and public keys are managed and thus enables you to receive and send Bitcoins. And this statement is also not entirely correct with regard to the use of a wallet of a crypto exchange. Because the wallets of crypto exchanges are so-called custodial wallets. This means that you do not have direct access to your private keys, but the corresponding exchange manages the keys for you.

The advantage of custodial wallets is that in this case you hand over the responsibility for storing your private keys. In this case, the Bitcoins or private keys do not really belong to you. You only rely on the provider's promise that they will keep the coins safe for you and give you access to your Bitcoins at any time. This dependency is associated with risks that should not be underestimated, since the exchanges as a central authority are always a worthwhile target for hackers and government intervention. In the past, many people have already lost their Bitcoins, especially due to hacker attacks. Even Satoshi Nakamoto gave the recommendation to always remain your own master of your Bitcoins. Therefore, the following guiding principles have been established in the Bitcoin scene: "Not your keys, not your coins" / "Never trust. Verify."

Non-Custodial Wallets

The alternative to Bitcoin storage on the Exchanges is therefore independent storage without the involvement of third parties with the establishment of its own security infrastructure.

Here, a distinction is made between hot wallets and cold wallets. Hot wallets are primarily software wallets that are always connected to the Internet, such as the open source wallet Electrum. As soon as a connection to the Internet is established, hot wallets are generally at risk of a hacker attack. That is why we do not recommend storing more Bitcoins in a hot wallet than you would carry cash in a wallet.

The term cold wallet, on the other hand, describes wallets that are never directly connected to the Internet. Software wallets such as the Electrum Wallet mentioned above can also be used as a cold wallet for the cold storage of Bitcoin. This is done by combining an online device and an offline device (e.g., using the software Tails). The implementation is a bit more technically demanding (read more hier) and is therefore only recommended for advanced users.

A very user-friendly and yet very secure cold wallet variant are the so-called hardware wallets such as Ledger, Trezor, Coldcard oder Bitbox02.. As the name suggests, these are wallets with a physical component on which the private keys are stored. To receive and send Bitcoins, the devices are connected to the computer using a USB port. However, the fact that the private keys never leave the device means that they are protected from hacker attacks. And this is even in case the connected computer is compromised.

The great advantage of non-custodial wallets is that you are in possession of your private keys yourself and are therefore independent of third parties. But as the saying goes - "with great power, comes great responsibility." If the private keys are lost, the Bitcoins are also lost forever. Therefore, it is incredibly important to set up your own security infrastructure to prevent a possible loss of your Bitcoins.

Back-Up via Seed Phrase

The wallets described above generally offer a very user-friendly back-up option due to their hierarchically deterministic architecture. With the help of a 12- or 24-word seed phrase, the wallets can be restored at any time and anywhere in the world, regardless of the software and hardware used. The private keys and public keys can then be deterministically derived by the wallet from the seed phrase.

Accordingly, responsible and discreet handling of the Seed Phrase is essential. Every person who has access to your seed phrase automatically has access to your Bitcoins. Therefore, the Seed Phrase should never be entered or stored on any computer or electronic device with online access.

However, a proper back-up of the Seed Phrase is essential. We strictly discourage brain wallet - memorizing the Seed Phrase. The simplest form of backup is to write down the seed phrase on a piece of paper. Most hardware wallet manufacturers include a small paper card on which the seed phrase can be noted. Considering that you can theoretically store your entire fortune in 12 or 24 words, we don't think a paper back-up is really appropriate. After all, the paper back-up is not really immune from a house fire, a flood or even a hungry dog.

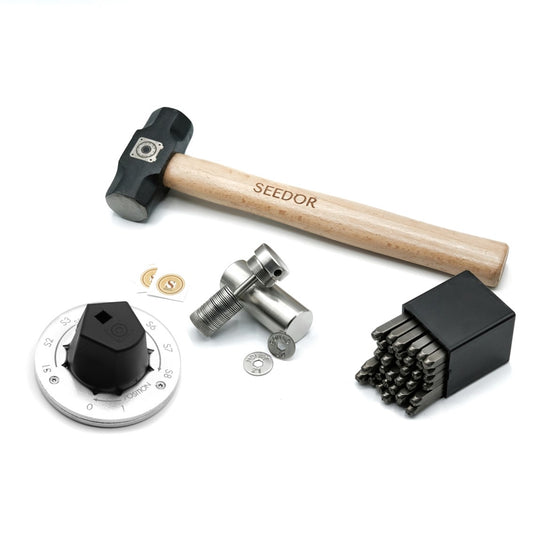

The safest option is considered to be storing the seed phrase in stainless steel. With the Seedor Safe Starter Set, we offer a user-friendly option for discreetly stamping the Bitcoin Seed Phrase in stainless steel on your own and thus storing it with the best possible protection against external influences for generations to come.